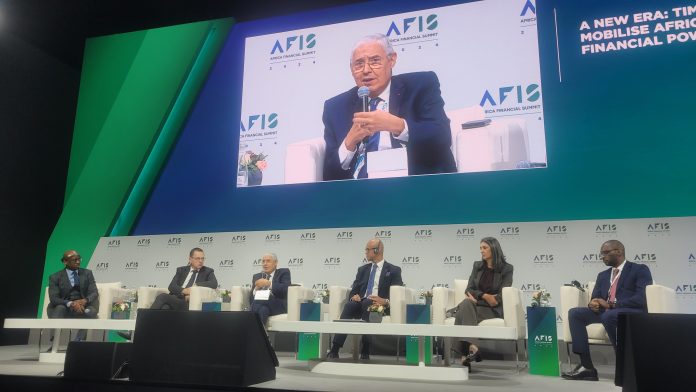

The Africa Financial Summit (AFIS-2024) opened its doors on Monday in Casablanca, drawing over 1,000 leaders from Africa’s financial sector, policymakers, and regulators. This high-profile event marks a pivotal moment as stakeholders gather to reimagine Africa’s financial landscape.

The opening session was graced by prominent Moroccan officials, including Nadia Fettah, Minister of Economy and Finance, Ryad Mezzour, Minister of Industry and Trade, and Karim Zidane, Minister Delegate in charge of Investment and Policy Evaluation. Their presence underscored Morocco’s commitment to positioning itself at the heart of Africa’s financial transformation.

The Rise of African financial powerhouses

Held under the theme “The Time for African Financial Powerhouses Has Come,” this year’s summit is the first to take place in Morocco. It serves as a platform for private-sector leaders and government representatives to explore strategies that position African finance as a driver of development, economic growth, and resilience.

Key discussions revolve around five transformative priorities:

- Innovative banking products: Developing capital market solutions to channel local resources into productive investments.

- Streamlining cross-border transactions: Cutting costs and reducing transaction times to boost intra-African trade.

- Strengthening financial institutions: Enhancing capital requirements and encouraging consolidation within the sector.

- Harnessing digitalization: Leveraging technology to offer tailored financial products to Africa’s informal workforce, which constitutes 83% of the economy.

- Creating a pan-African stock exchange: Addressing market fragmentation and fostering intra-African investments.

Towards a pan-African financial ecosystem

AFIS 2024 goes beyond theory, with over 30 high-level panels and discussions focusing on practical reforms. The summit addresses structural barriers and proposes actionable solutions to bolster the resilience of Africa’s financial sector amidst regional and global disruptions.

Youssef Rouissi, General Manager of Attijariwafa Bank, highlighted his institution’s pivotal role: “Our ambition is to create a bridge between African economies. By mobilizing local savings and offering tailored solutions, we are helping to build a shared future for the continent.”

The bank’s expansive presence in 27 countries enables it to lead efforts in enhancing intra-African trade and ensuring payment interoperability across borders.

Inclusion and innovation at the core

For Rouissi, financial inclusion is a cornerstone of economic progress: “We are investing in cutting-edge technology to expand banking services, particularly in rural areas. Our goal is to reduce inequalities while fostering economic growth.”

Attijariwafa Bank’s forward-thinking strategy emphasizes regional cooperation and sustainable development. Through partnerships with international financial hubs and innovative projects, the group is paving the way for a cohesive African market.

The path ahead for Africa’s financial future

AFIS 2024 underscores the collective drive to establish a unified, resilient financial ecosystem. With Casablanca as the backdrop, the summit signals a historic step towards integrating Africa’s economies and empowering its financial institutions to lead the continent into a new era of prosperity.