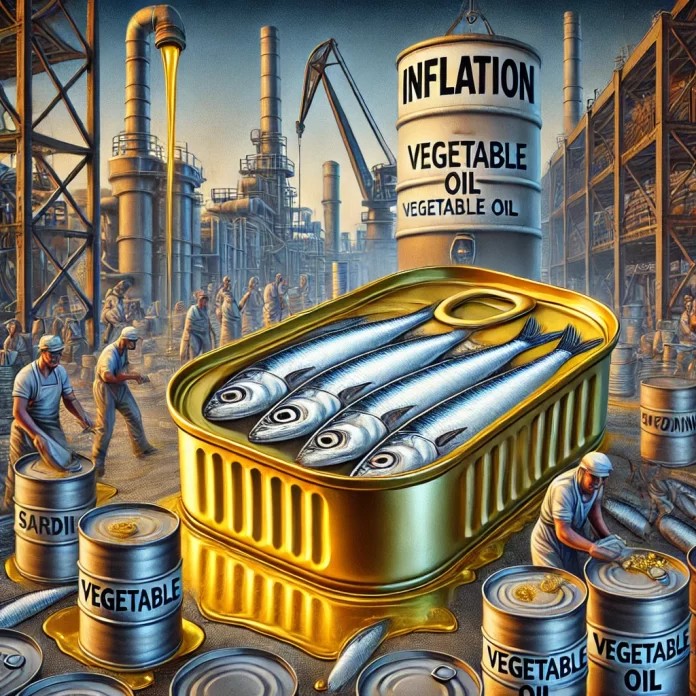

The relentless rise in vegetable oil prices has sent shockwaves through the food industry, hitting fish canneries especially hard. For a sector renowned for products like sardines in oil, this essential ingredient has transformed from a simple preservative to a financial headache. Confronted with record-breaking inflation, fish canneries are embracing inventive—and sometimes controversial—strategies to survive, striking a delicate balance between cost management and consumer satisfaction.

Vegetable oil inflation reaches new heights

Vegetable oil prices have surged dramatically in recent months, posing a serious challenge for fish canneries. According to the FAO, the global vegetable oil price index hit 164.1 points in November 2024—a 7.5% increase from the previous month and the highest level since mid-2022.

The spike stems from rising prices across palm, rapeseed, soybean, and sunflower oils. Palm oil, for example, has seen six consecutive months of price hikes due to poor harvests in Southeast Asia following excessive rainfall. Soybean oil has also grown more expensive amid soaring global demand, while rapeseed and sunflower oils reflect tightening global supplies.

Amid this upheaval, fish, particularly sardines, have paradoxically become cheaper than the oil used to preserve them. This unexpected shift is forcing canneries to rethink their processes, challenging longstanding norms in the industry.

A new dawn for sardines?

In response to rising oil costs, some canneries are reducing oil quantities in their tins while increasing the proportion of fish. While this may seem like a minor adjustment, it signals a significant shift in industry practices.

Consumers have begun noticing the difference. “It used to feel like my sardines were swimming in oil,” remarks Latifa, a long-time customer of canned fish. “Now, the tins are packed tighter with less oil.” While sardine enthusiasts might welcome the change, experts warn of potential downsides. Oil serves a vital role in preserving fish, preventing oxidation, and maintaining a tender texture. Reducing its quantity could compromise product quality or shelf life.

Clever innovation or marketing spin?

To address these concerns, canneries are introducing new strategies. Some now offer “light” products with reduced oil content, marketed as healthier options. Others are shrinking packaging sizes, offering less product without lowering prices.

Not everyone is convinced. “This is less about innovation and more about concealing inflation,” claims a food industry analyst. “Canneries are tightening margins by cramming more fish into tins, but the changes are subtle enough to fly under most consumers’ radar.”

Global competition and local solutions

The pressure on fish canneries isn’t just about rising costs. They also face fierce competition from international players like China and Vietnam, where government subsidies for oil production help keep prices low.

To remain competitive, some companies are experimenting with alternative oils. “We’re testing less expensive options like rapeseed oil or lower-grade olive oil,” shares one cannery executive. “It’s a risky move, but it’s necessary to stay in the game.”

Reimagining the future of canned fish

This shake-up may redefine how consumers perceive canned fish. With tins featuring more fish and less oil, buyers could interpret the change as a move toward higher-quality products—or feel misled by altered contents.

The industry is walking a tightrope. Decisions about ingredient substitutions, packaging tweaks, and product innovation are being closely monitored by increasingly savvy consumers.

For now, sardines are making a bigger splash on dinner tables than ever before. But how long can this trend last? The future of fish canneries will depend on their ability to strike the perfect balance between innovation, affordability, and consumer trust—an equation where every drop of oil makes a difference.