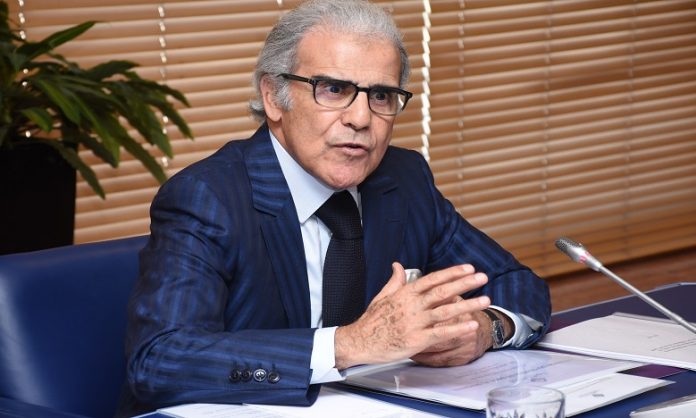

Morocco plans to resume the gradual easing of its currency exchange regime in 2026, following a pandemic-induced pause. Abdellatif Jouahri, Governor of Bank Al-Maghrib, confirmed this in an interview with Bloomberg News on the sidelines of the recent IMF and World Bank meetings in Washington.

Gradual shift from euro-dollar peg

This upcoming policy change means that the Moroccan dirham will gradually shift away from its current peg to a euro-dollar currency basket. The aim is to lessen Morocco’s dependency on these currencies’ volatility, allowing the dirham to more accurately reflect market dynamics.

Bank Al-Maghrib will retain a regulatory role, intervening as needed to curb excessive fluctuations. The dirham will thus be anchored to the central bank’s key interest rate and broader monetary policy, with strategic interventions in the foreign exchange market to maintain stability.

Morocco to issue $1 billion in eurobonds by early 2025

As part of its financial strategy, Morocco also plans to issue at least $1 billion in eurobonds by early 2025. This issuance is expected to support the country’s foreign reserves and offer flexibility to manage future currency adjustments, preparing Morocco for the next phase of its financial reforms.

This approach reflects Morocco’s commitment to adapting its currency policy to enhance economic resilience and support long-term growth in an increasingly globalized market.