Identical furniture, matching product codes, the same designs—and yet, the price tags in Moroccan stores belonging to major brands like IKEA and JYSK are consistently enough to make savvy shoppers do a double take. In many cases, the exact same items cost twice as much—or even more—compared to their prices in France. And no, the difference isn’t just a matter of currency conversion.

Take IKEA’s popular STRANDMON armchair in dark gray, for example. It sells for 299 euros in France. In Morocco? The exact same chair goes for 5,999 dirhams—nearly double, once you do the math. Same fabric, same design, but a price that’s hard to justify.

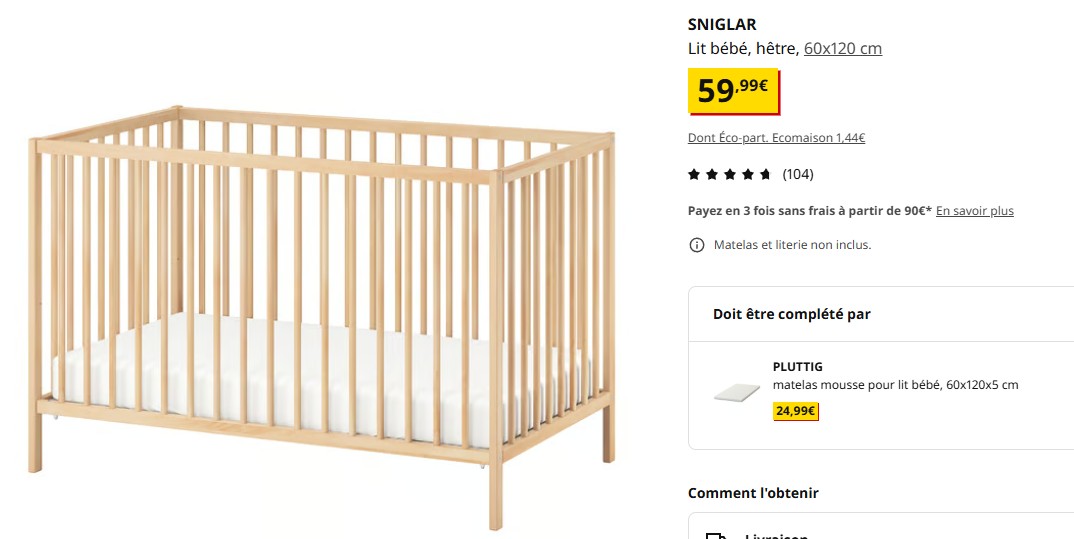

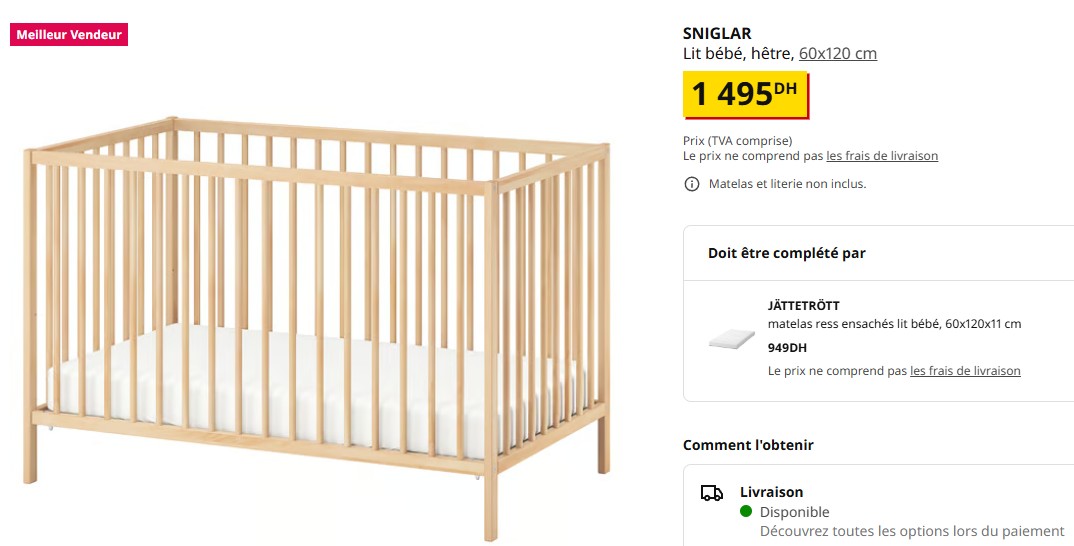

It’s not an isolated case. The SNIGLAR baby crib, made of beech wood and measuring 60×120 cm, is another example. In France, it’s listed at 59.99 euros—about 660 dirhams. In Morocco, the price jumps to 1,495 dirhams. That’s more than double, for an entry-level product that hasn’t been modified or upgraded in any way.

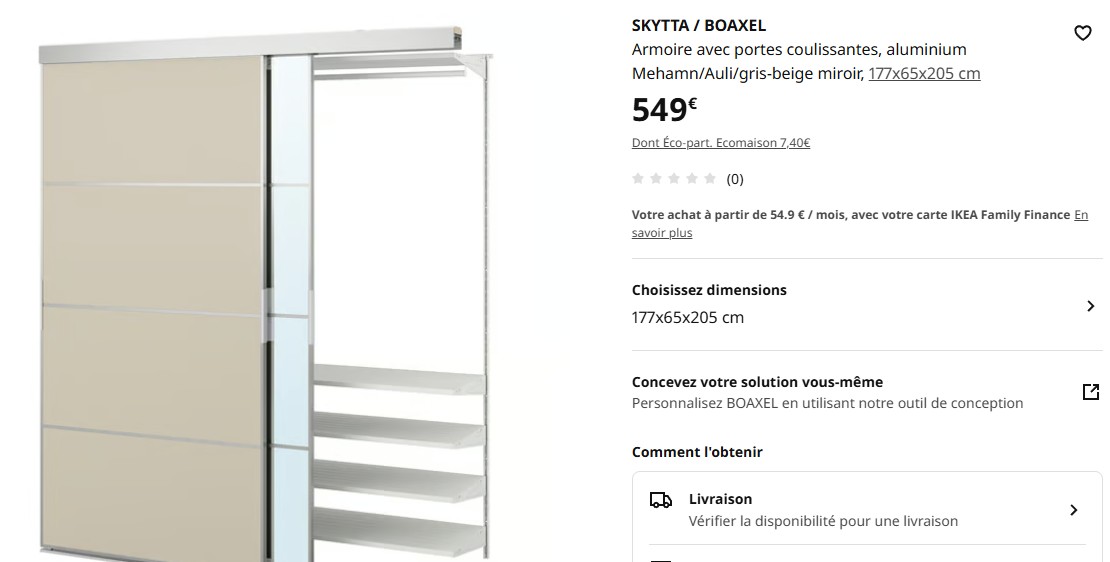

And then there’s the SKYTTA wardrobe system. Just a glance at side-by-side price comparisons circulating online makes the gap obvious—no explanation needed.

JYSK, another Scandinavian furniture chain, shows similar disparities. Their MARKSKEL bed frame, measuring 140×190 cm and available in white and natural oak, is advertised in France at 275 euros for Black Friday, down from a regular price of 349 euros. But on JYSK’s Moroccan site, the very same item is priced at 6,499 dirhams. That’s more than a 120% increase when compared to a straight currency conversion.

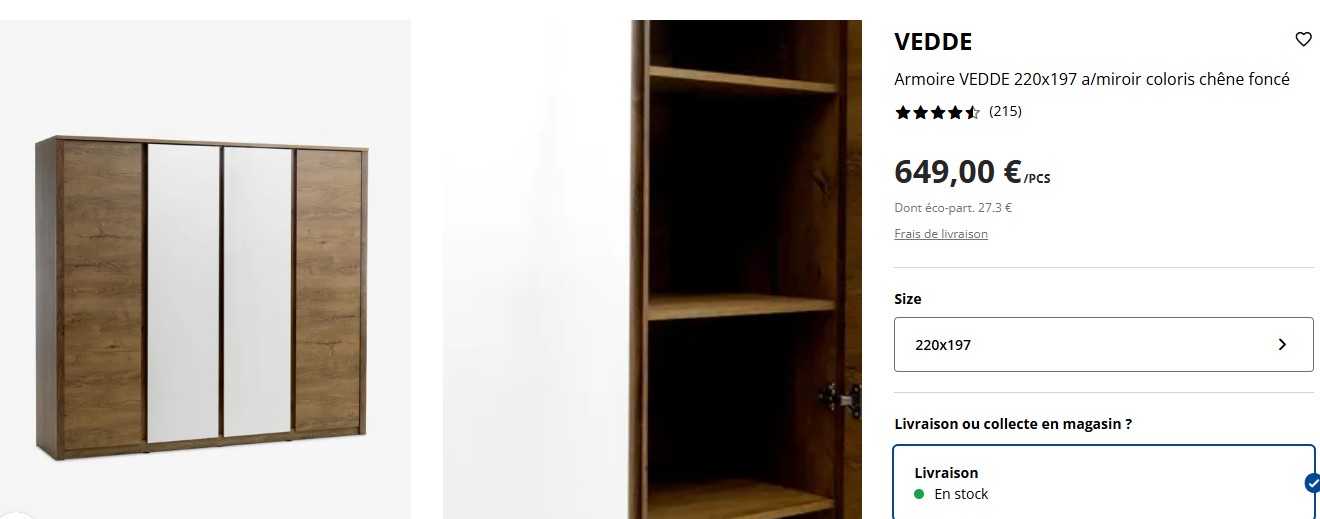

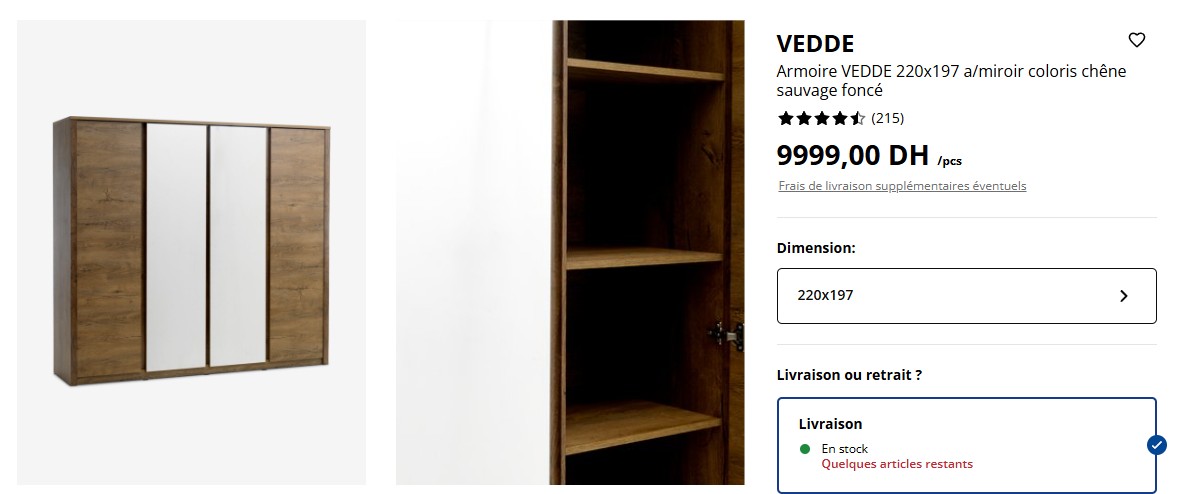

Same story for the VEDDE wardrobe, complete with mirror and measuring 220×197 cm. In France, it goes for 649 euros. In Morocco? A whopping 9,999 dirhams—even when on sale.

These pricing gaps are too consistent and too large to ignore. Retailers often cite a list of reasons: import fees, customs duties, shipping costs, local warehousing, taxes, salaries, and logistics—all of which Moroccan branches have to cover without the benefit of Europe’s large-scale distribution networks.

The volume argument is frequently repeated: in Europe, massive sales volumes allow for streamlined operations and bulk purchasing from suppliers, keeping prices low. Morocco, by contrast, is a smaller market with limited infrastructure and fewer units sold, meaning overhead costs are spread over a narrower base.

But for many consumers, those justifications don’t fully add up. When a basic piece of furniture, with no added features or services, ends up costing double, people naturally start asking questions. Some take to social media to share price comparisons, screenshots, and detailed breakdowns. Others look for workarounds: group buys from overseas, freight forwarding services, or grey-market channels that bypass local retailers altogether.

There’s growing concern that customers are being treated unequally—especially when a brand built on affordability and accessibility appears to be charging premium prices in one market over another. For many Moroccans, it’s now cheaper to order the same IKEA or JYSK item online from Europe, even after factoring in shipping fees.

Brands would do well to address the situation transparently. Breaking down their local pricing strategies, explaining the logistical challenges, or owning up to market-specific policies could go a long way in restoring trust. Without that clarity, frustration will only deepen, fueled by side-by-side comparisons, unexplained differences, and the lingering sense of being overcharged.