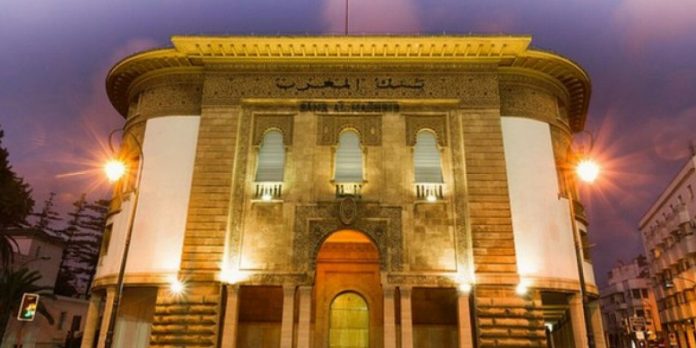

Bank Al-Maghrib (BAM) has released its weekly indicators for the period from July 11 to July 17, 2024, highlighting several key economic metrics.

Firstly, the dirham experienced a depreciation of 0.86% against the euro, indicating a slight weakening of the Moroccan currency in relation to the European currency.

During this period, there were no auction operations conducted on the foreign exchange market, reflecting a steady market environment without the need for BAM interventions.

In terms of official reserve assets, BAM reported a total of 361.3 billion dirhams. This figure represents a decrease of 0.4% from the previous week but shows a significant annual increase of 5.2%, underscoring the country’s strengthened financial position over the past year.

BAM’s average daily interventions in the money market amounted to 136.8 billion dirhams, demonstrating the central bank’s active role in managing liquidity within the banking system.

Finally, on the interbank market, the average daily volume of exchanges was recorded at 2.4 billion dirhams, with the interbank rate averaging 2.75%. This indicates stable and consistent activity in the interbank lending market, essential for the overall health of the financial system.

These indicators provide a snapshot of the current economic and financial landscape in Morocco, reflecting both challenges and strengths in the country’s monetary environment.